ABout our

Financial Empowerment

How are You Planning Your Life's Journey?

- Do you have a financial strategy that puts you ahead of the game?

- Are you on track to hit your retirement of financial goals?

- Are your financial portfolios well diversified?

- Are you using tax-differed retirement saving accounts or the IRS approved tax-free account?

- Do you have a smart college saving account to help your kids with their first college degree with zero debts?

- Do you own a home? Is your mortgage paid off or protected with a mortgage protection insurance that can pay off your mortgage if you get knocked down by life?

- Do you have an income protection or income replacement strategy in place to help you replace lost income in times of critical needs?

- Did you know that you can get up to $1.5 million of free money if run into a chronic, critical or terminal illness in future?

- If you were to stop breathing today, what will you leave to your loved ones? An Asset or A Liability? A Check or A Debt?

- Do you have an asset protection strategy or a financial portfolio that can protect your assets from lawsuits, creditors, predators and probate law?

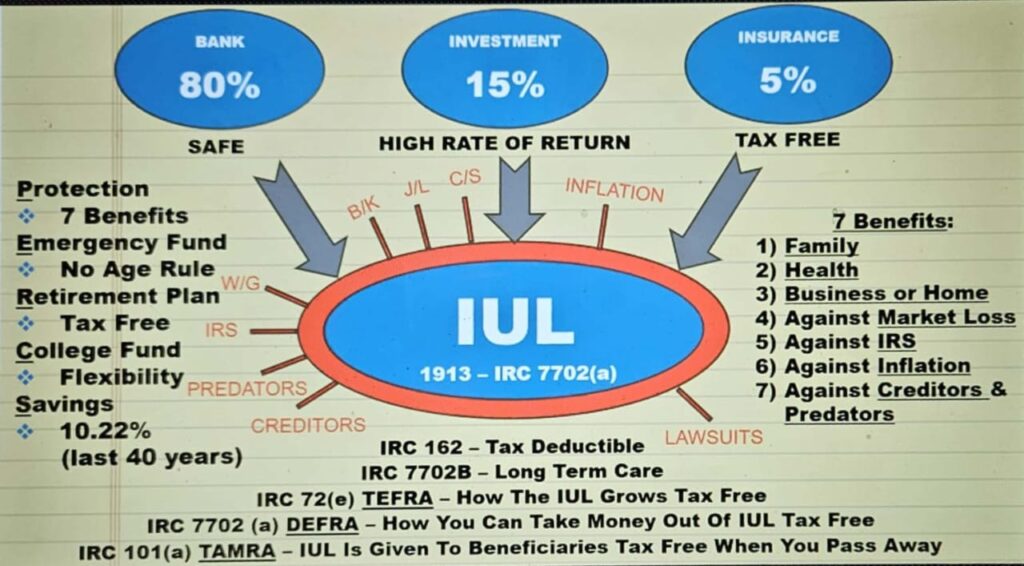

Advantages of Having an Indexed Universal Life (IUL)

It’s IRS-Approved allowing your money to grow tax-deferred and you can safely take out your money without paying a dime to “Uncle Sam”.

Builds rapid cash value by capturing the gains made by a stock market index and NEVER participating in the MARKET LOSSES.

Guarantees a lifetime stream of Tax-Free Retirement income.

Living Benefits income in case of critical, chronic and terminal illnesses.

Beats inflation in most cases due to the compounding of interest.

Principal is protected, and gains are locked in at the end of each index crediting period.

Provides permanent insurance coverage till ago 120 years

Can help you pay off your mortgage, tuition and any outstanding debts.

Avoids probate proceedings when owner passes away.

It’s the safest and easiest means to build generation wealth.

Understanding How Money Gets Taxed

A

- Bank Savings, CDs

- Money Markets

- Trading (Stocks, etfs, crypto)

- Mutual Funds

- Ordinary Bonds

- Sales and Others

B

- 401K, 403B, 457

- TRADITIONAL IRA

- SEP, SIMPLE, TSP

- ANNUITIES

- REAL ESTATES

- OTHERS

C

- CASH VALUE ACCUMULATION IN A LIFE INS. POLICY

- ROTH (IRA, TSP, 401K)

- MUNICIPAL BONDS

WHETHER YOU ARE A ...

Small Business Owner

Stock Market Trader

Real Estate Developer

Doctor

Verteran

Pharmacist

Attorney

An Employee

WE CAN OFFER YOU EXPERT ADVISE ON THE FOLLOWING

HOW TO MAKE MONEY WITHOUT LOSING IT

HOW TO LEGALLY LEVERAGE THE US FINANCIAL AND TAX SYSTEM TO:

- Protect your estate and survivors from the excessive taxation in the unfortunate event of your demise.

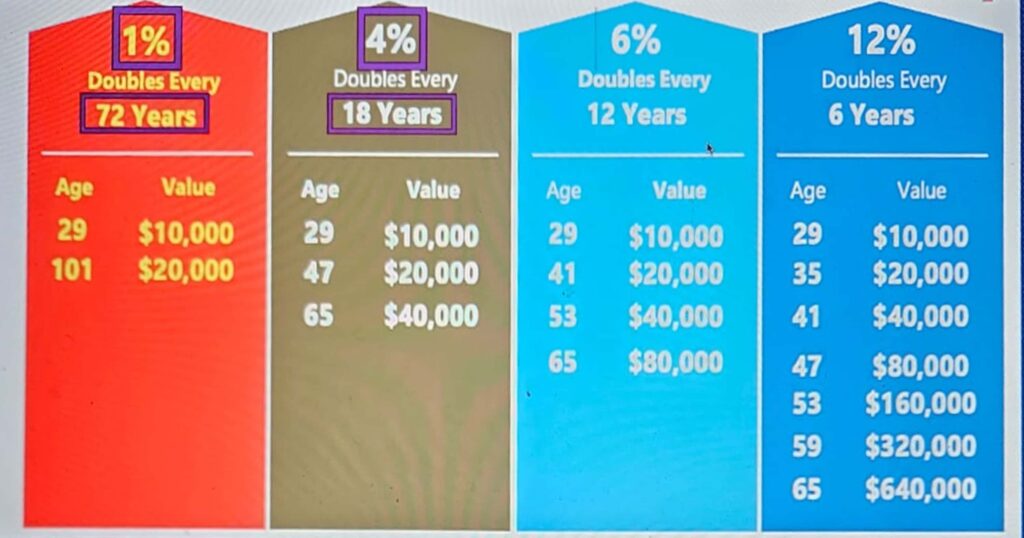

- Set up smart saving account that earns you uninterrupted compound interest year-in year-out.

- Overcome market fluctuations and out-pace inflation on your journey to financial freedom.

- Protect your income with strategies that will help you replace lost income in times of sickness, disability or death.

- Secure a lifetime stream of tax-free income during your retirement years.

- Pay off your mortgage within record time using other people’s money OPM.

- Fund your kids and grandkids college using the power of leverage or OPM.

- Optimize retirement accounts like the 401k, IRA, Roth IRA, 403B, TSP, for risk-free growth and tax-free distributions.

- Get up to $1.5 millions dollars of free living benefits should you become critically, chronically or terminally ill.

- Set up smart financial portfolios that are legally protected against probate, creditors and predators.

- Build and transfer wealth across generations income tax-free.

- Pay executive bonus compensation to your employees using other people’s money (OPM).

- Protect key employees in your corporation and get paid millions of dollars should a key employee dies or quits.

- Establish business buy-sell agreements to ensure business continually beyond the death of key partners or founders.

UNDERSTANDING THE RULE OF 72 (THE POWER OF COMPOUND INTEREST)

IUL IS HEAVILY REGULATED AND BACKED BY THE FOLLOWING SECTIONS OF THE INTERNAL REVENUE CODE (IRC)